You’ve worked hard to build a home that reflects your family’s vision. Don’t let a standard insurance policy put it all at risk.

At Concierge Insurance Group, we work with families who have designed or purchased custom-built homes in Georgia. These aren’t cookie-cutter properties, and your insurance coverage shouldn’t be either. If you're unsure whether your current policy truly protects your investment, this guide is for you.

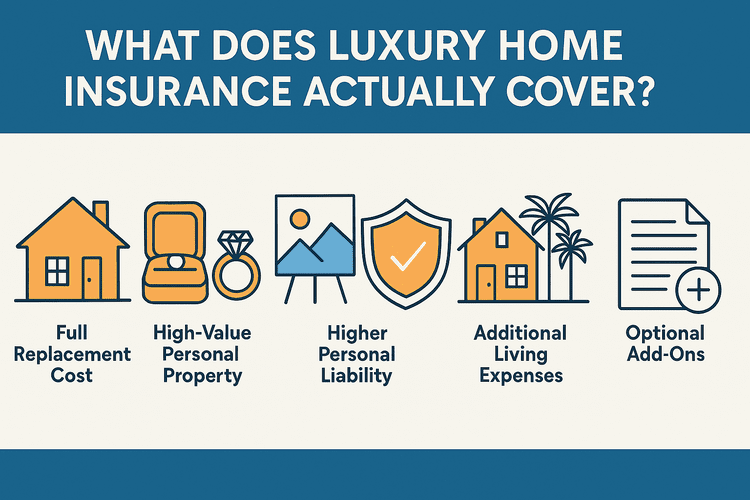

Let’s walk through exactly what luxury home insurance covers—and why it matters.

1. Full Replacement Cost for Your Home’s True Value

Most standard policies insure homes based on their current or depreciated market value. But luxury home insurance typically offers guaranteed or extended replacement cost coverage.

That means if your custom home is destroyed, your policy will pay to rebuild it exactly as it was, using the same high-end materials, architectural details, and finishes—even if construction costs exceed your original policy limits.

Why it matters: A $150 cabinet and a $2,500 custom cabinet are treated the same under most standard policies. We’ve seen families blindsided when their coverage only reimbursed 40% of what it cost to replace premium materials like countertops, cabinetry, or stonework. A luxury home policy ensures you won’t be forced to rebuild with substandard materials.

2. Protection for High-Value Personal Property

Standard homeowners policies typically cap coverage for valuable personal items—often at $1,000 to $2,500 per category.

Luxury insurance policies raise those limits substantially and can include personal articles floaters that insure specific high-value items individually.

Covered items may include:

- Jewelry and watches

- Fine art, antiques, and sculptures

- Wine collections and rare spirits

- High-end electronics and smart systems

- Designer furnishings and decor

Why it matters: These are often the most sentimental and irreplaceable items in your home. If you haven't scheduled them properly, a loss could leave you with pennies on the dollar.

3. Higher Personal Liability Limits

Luxury homes often come with increased liability exposure. Pools, outdoor kitchens, guesthouses, in-home staff, and teen drivers create real risks.

A luxury home policy offers elevated personal liability coverage and can be paired with umbrella insurance for even broader protection.

Why it matters: A standard $300,000 liability limit won’t go far if someone sues you for a serious injury on your property or if your teenager is involved in a major car accident. Families with assets to protect need coverage that matches their lifestyle.

4. Enhanced Additional Living Expenses (ALE)

If a covered event renders your home uninhabitable, you don’t want to be stuck in a small hotel with your entire family for six months.

Luxury home insurance includes elevated ALE coverage so you can rent a home that mirrors your current residence in size, location, and amenities.

Why it matters: You built your lifestyle around comfort and security. If disaster strikes, your family shouldn’t have to sacrifice either.

---

5. Optional Add-Ons for Unique Risk Exposures

Because no two custom homes are alike, luxury policies are flexible and include options such as:

- Cyber liability and identity theft

- Water backup and equipment breakdown

- Earthquake or flood coverage (often not included in standard homeowners insurance)

- Secondary home or vacation property coordination

- Employment practices liability (for families with domestic staff)

Why it matters: These are often the very risks that standard policies miss. A luxury policy builds in flexibility to reflect your unique lifestyle and assets.

You Deserve More Than Just a Policy

You deserve a plan that protects everything you’ve built.

At Concierge Insurance Group, we begin with a full risk audit tailored to your custom home, family, and lifestyle. We work directly with estate planners, CPAs, and real estate professionals to ensure your policy is aligned with your financial strategy—not just a checkbox.

If you’ve ever wondered:

- "Am I really covered for what my home is worth?"

- "What happens if someone gets hurt on my property?"

- "How do I protect my jewelry, art, or wine collection?"

We’re here to help.

---